lexoffice API Documentation

This documentation describes the set-up process, where to start with the API and the currently available endpoints. It moreover provides samples and suggestions on how to get the best out of the API.

Introduction

The lexoffice API is a REST API that allows developers to incorporate lexoffice into their applications by pushing and pulling data from and to lexoffice. Examples for this data are contact information and e.g. scanned images for bookkeeping vouchers (referred to as "files"). The responses of the endpoints are formatted in JSON.

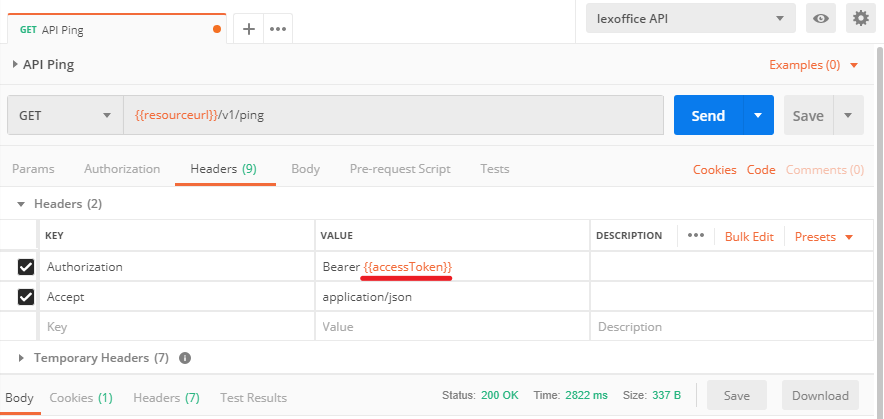

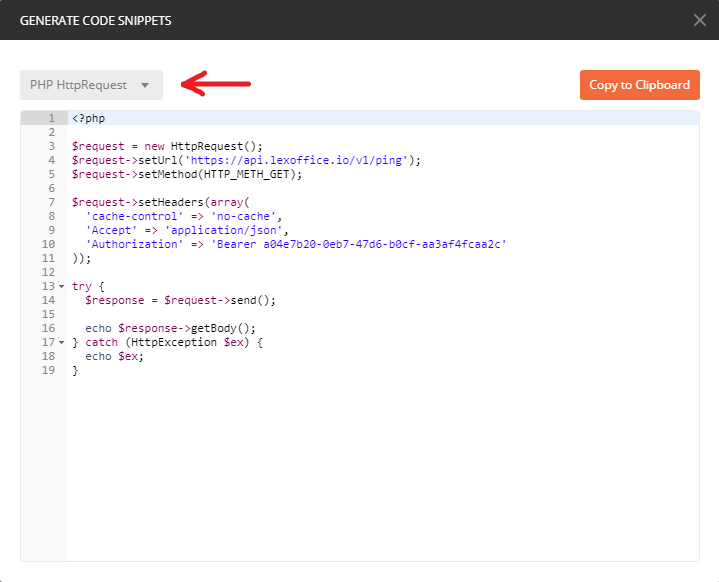

The lexoffice API endpoints are exposed by a gateway located at https://api.lexoffice.io. In the request examples throughout this documentation, we use placeholder variables {appbaseurl} to refer to the lexoffice application url, {resourceurl} to refer to the resource urls of the lexoffice API endpoints and {accessToken} to refer to the API key. We also use access token and API key interchangeably.

Users of the lexoffice API can generate their private API key at https://app.lexoffice.de/addons/public-api.

Additionally to this reference documentation, various cookbooks – lexoffice API Kochbücher – are available in German. They describe the concepts of aspects of the API from a high level perspective and are helpful as recipes for the implementation of lexoffice integrations.

API Rate Limits

lexoffice intends to provide a responsible API for a broad range of use cases to an equally broad range of API users. To make sure the API is responsive for everyone, a cap of the number of requests is in place.

The lexoffice API uses the token bucket algorithm to maintain a stable rate of requests. Our limits refer to all endpoints of the lexoffice API at the same time.

A client can make up to 2 requests per second to the lexoffice API.

Hitting the Rate Limits

If the rate of incoming requests exceeds the available limits, an HTTP response code 429 will be returned, and the actual call will not be performed.

Dealing with Rate Limits

Your implementation should make sure that our limits are not hit constantly, and that outgoing requests do not regularly exceed the provided limits. This can be obtained through various methods:

- Recommended: Use the token bucket algorithm on your side. Librarys for all major programming languages exist.

- Use a trivial "sleep" call between consecutive calls

- Make sure that the response code

429is handled appropriately, usually by retrying the call at a later time, possibly using exponential backoff

Please note that various layers of network infrastructure on your side, in "the internet", and on our side will result in jitter of request timing. Enforcing the mentioned limits without any buffer will commonly result in rate limited requests.

Articles Endpoint

Purpose

The articles endpoint provides read and write access to articles in lexoffice. These articles can be used in line items of sales vouchers such as invoices or quotations.

Article Properties

Sample of an article

{

"id": "eb46d328-e1dc-11ee-8444-2fadfc15a567",

"organizationId": "9e700f44-0c55-11ef-ac31-8f7c36d1b6e2",

"createdDate": "2023-09-21T17:46:40.629+02:00",

"updatedDate": "2024-05-03T12:21:32.120+02:00",

"archived": false,

"title": "Lexware buchhaltung Premium 2024",

"description": "Monatsabonnement. Mehrplatzsystem zur Buchhaltung. Produkt vom Marktführer. PC Aktivierungscode per Email",

"type": "PRODUCT",

"articleNumber": "LXW-BUHA-2024-001",

"gtin": "9783648170632",

"note": "Interne Notiz",

"unitName": "Download-Code",

"price": {

"netPrice": 61.90,

"grossPrice": 73.66,

"leadingPrice": "NET",

"taxRate": 19

},

"version": 2

}

| Property | Description |

|---|---|

iduuid |

Unique id of the article generated on creation by lexoffice. |

organizationIduuid |

Unique id of the organization the article belongs to. |

createdDate dateTime |

The instant of time when the article was created by lexoffice in format yyyy-MM-ddTHH:mm:ss.SSSXXX as described in RFC 3339/ISO 8601 (e.g. 2023-02-21T00:00:00.000+01:00).Read-only. |

updatedDate dateTime |

The instant of time when the article was updated by lexoffice in format yyyy-MM-ddTHH:mm:ss.SSSXXX as described in RFC 3339/ISO 8601 (e.g. 2023-02-21T00:00:00.000+01:00).Read-only. |

archived boolean |

Archived flag of the article. Read-only. |

titlestring |

Title of the article. |

descriptionstring |

Description of the article. |

typeenum |

Type of the article. Possible values are PRODUCT and SERVICE. |

articleNumberstring |

The article number as given by the user. |

gtinstring |

Global Trade Item Number (GTIN) of the article. If given, the value will be validated to match one of the GTIN-8, GTIN-12, GTIN-13, or GTIN-14 formats. |

notestring |

Internal note for the article. |

unitNamestring |

Unit name of the article. |

priceobject |

Price of the article. |

version integer |

Version (revision) number which will be increased on each change to handle optimistic locking. Read-only. |

Price object details

| Property | Description |

|---|---|

netPricenumber |

The net price of the article. Read-only, if the leadingPrice is GROSS. |

grossPricenumber |

The gross price of the article. Read-only, if the leadingPrice is NET. |

leadingPriceenum |

The leading price type. Possible values are NET and GROSS. For read access, this value reflects the price that was last set in lexoffice, or the leadingPrice value of the last API write operation. For write access, it reflects which price is passed by the client; the other price one will be calculated based on the leading price and the given tax rate. |

taxRatenumber |

The tax rate applied to the article price. As of March 2024, possible values are 0, 7, and 19. |

Create an Article

Sample request to create an article

curl https://api.lexoffice.io/v1/articles

-X POST

-H "Authorization: Bearer {accessToken}"

-H "Content-Type: application/json"

-H "Accept: application/json"

-d '

{

"title": "Lexware buchhaltung Premium 2024",

"type": "PRODUCT",

"unitName": "Download-Code",

"articleNumber": "LXW-BUHA-2024-001",

"price": {

"netPrice": 61.90,

"leadingPrice": "NET",

"taxRate": 19

}

}'

POST {resourceurl}/v1/articles

The contents of the article are expected in the request’s body as an application/json.

Description of required properties when creating an article:

| Property | Required | Notes |

|---|---|---|

| title | Yes | |

| type | Yes | |

| unitName | Yes | |

| price | Yes | Nested object, see below. |

Price Required Properties

| Property | Required | Notes |

|---|---|---|

| netPrice | * | Required if leadingPrice is NET |

| grossPrice | * | Required if leadingPrice is GROSS |

| leadingPrice | Yes | |

| taxRate | Yes |

Sample response

{

"id": "f5d5e4c2-e20a-11ee-9cde-7789c0d1fa1c",

"resourceUri": "https://api.lexoffice.io/v1/articles/f5d5e4c2-e20a-11ee-9cde-7789c0d1fa1c",

"createdDate": "2024-03-14T14:58:10.320+01:00",

"updatedDate": "2024-03-14T14:58:10.320+01:00",

"version": 0

}

Retrieve an Article

Sample request

curl https://api.lexoffice.io/v1/articles/f5d5e4c2-e20a-11ee-9cde-7789c0d1fa1c

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample response

{

"id": "eb46d328-e1dc-11ee-8444-2fadfc15a567",

"title": "Lexware buchhaltung Premium 2024",

"description": "Monatsabonnement. Mehrplatzsystem zur Buchhaltung. Produkt vom Marktführer. PC Aktivierungscode per Email",

"type": "PRODUCT",

"articleNumber": "LXW-BUHA-2024-001",

"gtin": "9783648170632",

"note": "Interne Notiz",

"unitName": "Download-Code",

"price": {

"netPrice": 61.90,

"grossPrice": 73.66,

"leadingPrice": "NET",

"taxRate": 19

},

"version": 0

}

GET {resourceurl}/v1/articles/{id}

Returns the article with id value {id}.

Update an Article

PUT {resourceurl}/v1/articles/{id}

Sample request to update an existing article

curl https://api.lexoffice.io/v1/articles/eb46d328-e1dc-11ee-8444-2fadfc15a567

-X PUT

-H "Authorization: Bearer {accessToken}"

-H "Content-Type: application/json"

-H "Accept: application/json"

-d '

{

"title": "Lexware buchhaltung Premium 2024",

"description": "Monatsabonnement. Mehrplatzsystem zur Buchhaltung. Produkt vom Marktführer. PC Aktivierungscode per Email",

"type": "PRODUCT",

"articleNumber": "LXW-BUHA-2024-001",

"gtin": "9783648170632",

"note": "Internal note",

"unitName": "Download-Code",

"price": {

"netPrice": 61.90,

"grossPrice": 73.66,

"leadingPrice": "NET",

"taxRate": 19

},

"version": 1

}

'

Sample response

{

"id": "eb46d328-e1dc-11ee-8444-2fadfc15a567",

"resourceUri": "https://api.lexoffice.io/v1/articles/eb46d328-e1dc-11ee-8444-2fadfc15a567",

"createdDate": "2024-03-14T14:58:10.320+01:00",

"updatedDate": "2024-04-29T16:12:09.512+02:00",

"version": 2

}

Update an existing article with id {id} with the data given in the payload as JSON. Returns an action result on success.

For information about required fields please see Create an article.

Delete an Article

DELETE {resourceurl}/v1/articles/{id}

Deletes the article with id value {id}.

Returns 204 on success, or 404 if the id does not exist.

Filtering Articles

GET {resourceurl}/v1/articles?filter_1=value_1&...&filter_n=value_n

Sample request for retrieving all articles

curl https://api.lexoffice.io/v1/articles?page=0

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample response

{

"content": [

{

"id": "eb46d328-e1dc-11ee-8444-2fadfc15a567",

"title": "Lexware buchhaltung Premium 2024",

"description": "Monatsabonnement. Mehrplatzsystem zur Buchhaltung. Produkt vom Marktführer. PC Aktivierungscode per Email",

"type": "PRODUCT",

"articleNumber": "LXW-BUHA-2024-001",

"gtin": "9783648170632",

"note": "Interne Notiz",

"unitName": "Download-Code",

"price": {

"netPrice": 61.90,

"grossPrice": 73.66,

"leadingPrice": "NET",

"taxRate": 19

},

"version": 1

},

{

"id": "f7e14ba6-e2ac-11ee-96c1-3b561501789e",

"title": "Lexware warenwirtschaft Premium 2024",

"description": "Monatsabonnement. Mehrplatzsystem zur kompletten Warenwirtschaft. Produkt vom Marktführer. PC Aktivierungscode per Email",

"type": "PRODUCT",

"articleNumber": "LXW-WAWI-2024-001",

"gtin": "9783648170779",

"note": "Interne Notiz",

"unitName": "Download-Code",

"price": {

"netPrice": 61.90,

"grossPrice": 73.66,

"leadingPrice": "NET",

"taxRate": 19

},

"version": 3

}

],

"totalPages": 1,

"totalElements": 2,

"last": true,

"sort": [

{

"direction": "ASC",

"property": "title",

"ignoreCase": false,

"nullHandling": "NATIVE",

"ascending": true

}

],

"size": 25,

"number": 0,

"first": true,

"numberOfElements": 2

}

Returns the articles that fulfill the criteria given by filters filter_1 to filter_n using a paging mechanism. If more than one filter is given, the logical connector is AND. Filters that are not set are ignored.

To check the maximum page size for this endpoint, see Paging of Resources.

Note that a filter should not be present more than once in a request.

The following table describes the possible filter parameters.

| Parameter | Description |

|---|---|

articleNumberstring |

Returns the article with the given article number in a page element, or an empty page otherwise. |

gtinstring |

Returns a page of articles with the given GTIN |

typeenum |

Filters by the given type. Possible values are PRODUCT and SERVICE. |

Contacts Endpoint

Purpose

This endpoint provides read access to contacts (e.g. customers, vendors). A contact can hold addresses, contact information (e.g. phone numbers, email addresses) and contact persons for company related contacts. It is also possible to use filters on the contacts collection.

Contact Properties

Sample of a contact with roles customer and vendor

{

"id": "be9475f4-ef80-442b-8ab9-3ab8b1a2aeb9",

"organizationId": "aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"version": 1,

"roles": {

"customer": {

"number": 10307

},

"vendor": {

"number": 70303

}

},

"company": {

"name": "Testfirma",

"taxNumber": "12345/12345",

"vatRegistrationId": "DE123456789",

"allowTaxFreeInvoices": true,

"contactPersons": [

{

"salutation": "Herr",

"firstName": "Max",

"lastName": "Mustermann",

"primary": true,

"emailAddress": "contactpersonmail@lexoffice.de",

"phoneNumber": "08000/11111"

}

]

},

"addresses": {

"billing": [

{

"supplement": "Rechnungsadressenzusatz",

"street": "Hauptstr. 5",

"zip": "12345",

"city": "Musterort",

"countryCode": "DE"

}

],

"shipping": [

{

"supplement": "Lieferadressenzusatz",

"street": "Schulstr. 13",

"zip": "76543",

"city": "MUsterstadt",

"countryCode": "DE"

}

]

},

"xRechnung": {

"buyerReference": "04011000-1234512345-35",

"vendorNumberAtCustomer": "70123456"

},

"emailAddresses": {

"business": [

"business@lexoffice.de"

],

"office": [

"office@lexoffice.de"

],

"private": [

"private@lexoffice.de"

],

"other": [

"other@lexoffice.de"

]

},

"phoneNumbers": {

"business": [

"08000/1231"

],

"office": [

"08000/1232"

],

"mobile": [

"08000/1233"

],

"private": [

"08000/1234"

],

"fax": [

"08000/1235"

],

"other": [

"08000/1236"

]

},

"note": "Notizen",

"archived": false

}

| Property | Description |

|---|---|

id uuid |

Unique id of the contact generated on creation by lexoffice. |

organizationId uuid |

Unique id of the organization the contact belongs to. |

version integer |

Version (revision) number which will be increased on each change to handle optimistic locking. Read-only. |

roles object |

Defines contact roles and supports further contact information. For object details see below. |

company object |

Company related information. For details see below. |

person object |

Individual person related information. For details see below. |

addresses object |

Addresses (e.g. billing and shipping address(es)) for the contact. Contains a list for each address type. For details see below. |

xRechnung object |

XRechnung related properties of the contact |

emailAddresses object |

Email addresses for the contact. Contains a list for each email type in lexoffice. For details see below. |

phoneNumbers object |

Phone numbers for the contact. Contains a list for each phone number type in lexoffice. For details see below. |

note string |

A note to the contact with a maximum length of 1000 characters. This is just additional information. |

archived boolean |

Archived flag of the contact. Read-only. |

Roles Details

Contains a customer and/or a vendor object. The presence of a role in the JSON implies that the contact will have this role. For example, if the customer object is present, the contact has the role customer. Please note that each contact must have at least one role.

| Property | Description |

|---|---|

customer object |

May be present. If present the created contact has the role customer. |

vendor object |

May be present. If present the created contact has the role vendor. |

Customer Details

| Property | Description |

|---|---|

number integer |

Unique customer number within the current organization. This number is created by lexoffice for contacts with role Customer. It cannot be set during creation and cannot be changed. Read-only. |

Vendor Details

| Property | Description |

|---|---|

number integer |

Unique vendor number within the current organization. This number is created by lexoffice for contacts with role Vendor. It cannot be set during creation and cannot be changed. Read-only. |

Company Details

Use this object to provide information for a contact of type company.

| Property | Description |

|---|---|

allowTaxFreeInvoices boolean |

Possible values are true or false. |

name string |

Company name |

taxNumber string |

Tax number for this company --> "Steuernummer". |

vatRegistrationId string |

Vat registration id for this company. This id has to follow the german rules for the vat registration ids --> "Umsatzsteuer ID". |

contactPersons list |

A list of company contact persons. Each entry is an object of company contact person. Details of nested object please see below. |

Company Contact Person Details

| Property | Description |

|---|---|

salutation string |

Salutation for the contact person with max length of 25 characters. |

firstName string |

First name of the contact person. |

lastName string |

Last name of the contact person. |

primary boolean |

Flags if contact person is the primary contact person. Primary contact persons are shown on vouchers. Default is false. |

emailAddress string |

Email address of the contact person. |

phoneNumber string |

Phone number of the contact person. |

Person Details

Sample json for a contact of type private person

{

"id": "e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"organizationId": "aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"version": 0,

"roles": {

"customer": {

"number": 10308

}

},

"person": {

"salutation": "Frau",

"firstName": "Inge",

"lastName": "Musterfrau"

},

"archived": false

}

Use this object to provide information for a contact of type private person.

| Property | Description |

|---|---|

salutation string |

Salutation for the individual person with max length of 25 characters. |

firstName string |

First name of the person. |

lastName string |

Last name of the person. |

Addresses Details

Use this objects to provide billing and shipping information of a contact.

| Property | Description |

|---|---|

billing list |

A list of billing addresses. Each entry is an object of address. |

shipping list |

A list of shipping addresses. Each entry is an object of address. |

Address Details

| Property | Description |

|---|---|

supplement string |

Additional address information. |

street string |

Street with Street number. |

zip string |

Zip code |

city string |

City |

countryCode string |

Country code in the format of ISO 3166 alpha2 (e.g. DE is used for germany). |

XRechnung Details

If a customer's buyerReference is set, its vendorNumberAtCustomer needs to be set as well.

| Property | Description |

|---|---|

buyerReference string |

Customer's Leitweg-ID conforming to the German XRechnung system |

vendorNumberAtCustomer string |

Your vendor number as used by the customer |

E-Mail Addresses Details

| Property | Description |

|---|---|

business list |

A list of email addresses. Each entry is of type string and contains an email address. |

office list |

A list of email addresses. Each entry is of type string and contains an email address. |

private list |

A list of email addresses. Each entry is of type string and contains an email address. |

other list |

A list of email addresses. Each entry is of type string and contains an email address. |

Phone Numbers Details

| Property | Description |

|---|---|

business list |

A list of phone numbers. Each entry is of type string and contains a phone number. |

office list |

A list of phone numbers. Each entry is of type string and contains a phone number. |

mobile list |

A list of phone numbers. Each entry is of type string and contains a phone number. |

private list |

A list of phone numbers. Each entry is of type string and contains a phone number. |

fax list |

A list of phone numbers. Each entry is of type string and contains a phone number. |

other list |

A list of phone numbers. Each entry is of type string and contains a phone number. |

Create a Contact

Sample request to create a customer

curl https://api.lexoffice.io/v1/contacts

-X POST

-H "Authorization: Bearer {accessToken}"

-H "Content-Type: application/json"

-H "Accept: application/json"

-d '

{

"version": 0,

"roles": {

"customer": {

}

},

"person": {

"salutation": "Frau",

"firstName": "Inge",

"lastName": "Musterfrau"

},

"note": "Notizen"

}'

Sample response

{

"id": "66196c43-baf3-4335-bfee-d610367059db",

"resourceUri": "https://api.lexoffice.io/v1/contacts/66196c43-bfee-baf3-4335-d610367059db",

"createdDate": "2023-06-29T15:15:09.447+02:00",

"updatedDate": "2023-06-29T15:15:09.447+02:00",

"version": 1

}

POST {resourceurl}/v1/contacts

The contents of the contact are expected in the request’s body as an application/json.

Description of required properties when creating a customer.

| Property | Required | Notes |

|---|---|---|

| version | Yes | Set to 0 |

| roles | Yes | Each customer must have at least one role. The role must be set as an empty object. |

| company | * | If the contact is of type company it must be set. |

| person | * | If the contact is of type person it must be set. |

Company Details

| Property | Required | Notes |

|---|---|---|

| name | Yes | Must not be empty if customer is of type company. |

Company Contact Person Details

| Property | Required | Notes |

|---|---|---|

| salutation | No | Changed to optional (see Change Log). |

| lastName | Yes | Must be not empty if customer is of type company. |

Person Details

| Property | Required | Notes |

|---|---|---|

| salutation | No | Changed to optional (see Change Log). |

| lastName | Yes | Must be not empty if customer is of type person. |

Address Details

| Property | Required | Notes |

|---|---|---|

| countryCode | Yes | Must be not empty. Must contain the country code in the format of ISO 3166 alpha2 (e.g. DE is used for germany). |

Retrieve a Contact

Sample request

curl https://api.lexoffice.io/v1/contacts/e9066f04-8cc7-4616-93f8-ac9ecc8479c8

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample response

{

"id": "e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"organizationId": "aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"version": 0,

"roles": {

"customer": {

"number": 10308

}

},

"person": {

"salutation": "Frau",

"firstName": "Inge",

"lastName": "Musterfrau"

},

"note": "Notizen",

"archived": false

}

GET {resourceurl}/v1/contacts/{id}

Returns the contact with id value {id}.

Update a Contact

PUT {resourceurl}/v1/contacts/{id}

Update an existing contact with id {id} with the data given in the payload as JSON. Returns an action result on success.

For information about required fields please see Create a contact.

addresses.billingaddresses.shippingemailAddresses.businessemailAddresses.officeemailAddresses.privateemailAddresses.otherphoneNumbers.businessphoneNumbers.officephoneNumbers.mobilephoneNumbers.privatephoneNumbers.faxphoneNumbers.othercompany.contactPersons

Filtering Contacts

GET {resourceurl}/v1/contacts?filter_1=value_1&...&filter_n=value_n

Sample request for retrieving all contacts

curl https://api.lexoffice.io/v1/contacts?page=0

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample response

{

"content": [

{

"id": "e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"organizationId": "aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"version": 0,

"roles": {

"customer": {

"number": 10308

}

},

"person": {

"salutation": "Frau",

"firstName": "Inge",

"lastName": "Musterfrau"

},

"archived": false

},

{

"id": "313ef116-a432-4823-9dfe-1b1200eb458a",

"organizationId": "aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"version": 0,

"roles": {

"customer": {

"number": 10309

}

},

"person": {

"salutation": "Herr",

"firstName": "Max",

"lastName": "Mustermann"

},

"archived": true

}

],

"totalPages": 1,

"totalElements": 2,

"last": true,

"sort": [

{

"direction": "ASC",

"property": "name",

"ignoreCase": false,

"nullHandling": "NATIVE",

"ascending": true

}

],

"size": 25,

"number": 0,

"first": true,

"numberOfElements": 2

}

Sample request for a filter with email max@gmx.de and name Mustermann:

curl https://api.lexoffice.io/v1/contacts?email=max@gmx.de&name=Mustermann

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample call Filter only vendor contacts:

curl https://api.lexoffice.io/v1/contacts?vendor=true&customer=false

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Returns the contacts that fulfill the criteria given by filters filter_1 to filter_n using a paging mechanism. If more than one filter is given, the logical connector is AND. Filters that are not set are ignored.

To check the maximum page size for this endpoint, see Paging of Resources.

Note that a filter should not be present more than once in a request.

The following table describes the possible filter parameters.

| Parameter | Description |

|---|---|

email string |

filters contacts where any of their email addresses inside the emailAddresses object or in company contactPersons match the given email value. At least 3 characters are necessary to successfully complete the query. |

name string |

filters contacts whose name matches the given name value. At least 3 characters are necessary to successfully complete the query. |

number integer |

returns the contacts with the specified contact number. Number is either the customer number or the vendor number located in the roles object. |

customer boolean |

if set to true filters contacts that have the role customer. If set to false filters contacts that do not have the customer role. |

vendor boolean |

if set to true filters contacts that have the role vendor. If set to false filters contacts that do not have the vendor role. |

Examples of pattern matching:

email=a_b@example.comwill finda.b@example.com,a_b@example.com, andazb@example.comemail=a\_b@example.comwill only finda_b@example.comemail=a%b@examplewill finda.b@example.com,a_b@example.com,azb@example.com, andanna.and.jacob@example.comemail=n_d_e@example.comwill find bothjohn.doe@example.comandn_d_e@example.com⚠️

Deeplink to Contacts

Newly created contacts can be accessed via the following deeplink for further processing by the user — for example, to adjust or complete contact details not available through the API.

View URL {appbaseurl}/permalink/contacts/view/{contactId}

Countries Endpoint

Purpose

The countries endpoint provides read access to the list of countries known to lexoffice.

Country properties

| Property | Description |

|---|---|

countryCodestring |

The country's code. See our FAQ for specification. |

countryNameENstring |

Country name (English) |

countryNameDEstring |

Country name (German translation) |

taxClassificationenum |

Tax classification. Possible values are de (Germany), intraCommunity (eligible for Innergemeinschaftliche Lieferung), and thirdPartyCountry (other). See below |

Country tax classification

The tax classification as supplied by the countries endpoint refers to the current classification of the country. As countries enter or leave the EU, their classification may be subject to change. At this time, the countries endpoint will always return the current state.

When a country bearing the intraCommunity classification is referred to in vouchers, their tax type may be eligible to be set to intraCommunitySupply. However, that

decision may be based on other properties of the organization and the referenced contact information.

Retrieve List of Countries

Sample request

curl https://api.lexoffice.io/v1/countries

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample Response

[

{

"countryCode": "DE",

"countryNameDE": "Deutschland",

"countryNameEN": "Germany",

"taxClassification": "de"

},

{

"countryCode": "FR",

"countryNameDE": "Frankreich",

"countryNameEN": "France",

"taxClassification": "intraCommunity"

},

{

"countryCode": "US",

"countryNameDE": "Vereinigte Staaten von Amerika",

"countryNameEN": "United States",

"taxClassification": "thirdPartyCountry"

}

]

GET {resourceurl}/v1/countries

The following sample shows how to retrieve list of currently known countries. It is required to replace the placeholder {accessToken} before sending the request.

Credit Notes Endpoint

Purpose

This endpoint provides read and write access to credit notes and also the possibility to render the document as a PDF in order to download it. Credit notes can be created as a draft or finalized in open mode.

With a credit note the partial or full amount of an invoice can be refunded to a customer.

A credit note may be related to an invoice but can also be standalone without any reference to an invoice. If related to an invoice, the credit note's status will immediately switch to paidoff on finalization and the open payment amount of the related invoice is either reduced or completely paid. There can only be one credit note related to an invoice. An unrelated and finalized credit note will remain in status open until the lexoffice user assigns the payment in lexoffice. Please note, that the printed document does not show the related invoice resp. the invoice number. However, to show the invoice number, it can simply be included in the header text (introduction).

It is possible to create credit notes with value-added tax such as of type net (Netto), gross (Brutto) or different types of vat-free. For tax-exempt organizations vat-free (Steuerfrei) credit notes can be created exclusively. All other vat-free tax types are only usable in combination with a referenced contact in lexoffice. For recipients within the EU these are intra-community supply (Innergemeinschaftliche Lieferung gem. §13b UStG), constructional services (Bauleistungen gem. §13b UStG) and external services (Fremdleistungen innerhalb der EU gem. §13b UStG). For credit notes to third countries, the tax types third party country service (Dienstleistungen an Drittländer) and third party country delivery (Ausfuhrlieferungen an Drittländer) are possible.

Credit Notes Properties

Sample of a credit note with multiple line items. Fields with no content are displayed with "null" just for demonstration purposes.

{

"id":"e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"organizationId":"aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"createdDate":"2023-06-17T18:32:07.480+02:00",

"updatedDate":"2023-06-17T18:32:07.551+02:00",

"version":1,

"language":"de",

"archived":false,

"voucherStatus":"draft",

"voucherNumber":"GS0007",

"voucherDate":"2023-02-22T00:00:00.000+01:00",

"address":{

"name":"Bike & Ride GmbH & Co. KG",

"supplement":"Gebäude 10",

"street":"Musterstraße 42",

"city":"Freiburg",

"zip":"79112",

"countryCode":"DE"

},

"electronicDocumentProfile":"NONE",

"lineItems":[

{

"type":"custom",

"name":"Abus Kabelschloss Primo 590 ",

"description":"· 9,5 mm starkes, smoke-mattes Spiralkabel mit integrierter Halterlösung zur Befestigung am Sattelklemmbolzen · bewährter Qualitäts-Schließzylinder mit praktischem Wendeschlüssel · KabelØ: 9,5 mm, Länge: 150 cm",

"quantity":2,

"unitName":"Stück",

"unitPrice":{

"currency":"EUR",

"netAmount":13.4,

"grossAmount":15.946,

"taxRatePercentage":19

},

"lineItemAmount":26.8

},

{

"type":"custom",

"name":"Energieriegel Testpaket",

"quantity":1,

"unitName":"Stück",

"unitPrice":{

"currency":"EUR",

"netAmount":5,

"grossAmount":5,

"taxRatePercentage":0

},

"lineItemAmount":5

}

],

"totalPrice":{

"currency":"EUR",

"totalNetAmount":31.8,

"totalGrossAmount":36.89,

"totalTaxAmount":5.09

},

"taxAmounts":[

{

"taxRatePercentage":0,

"taxAmount":0,

"netAmount":5

},

{

"taxRatePercentage":19,

"taxAmount":5.09,

"netAmount":26.8

}

],

"taxConditions":{

"taxType":"net"

},

"relatedVouchers":[],

"printLayoutId": "28c212c4-b6dd-11ee-b80a-dbc65f4ceccf",

"title":"Rechnungskorrektur",

"introduction":"Rechnungskorrektur zur Rechnung RE-00020",

"remark":"Folgende Lieferungen/Leistungen schreiben wir Ihnen gut.",

"files":{

"documentFileId":"a79fea19-a892-4ea9-89ad-e879946329a3"

}

}

| Property | Description |

|---|---|

id uuid |

Unique id generated on creation by lexoffice. Read-only. |

organizationId uuid |

Unique id of the organization the credit note belongs to. Read-only. |

createdDate dateTime |

The instant of time when the credit note was created by lexoffice in format yyyy-MM-ddTHH:mm:ss.SSSXXX as described in RFC 3339/ISO 8601 (e.g. 2023-02-21T00:00:00.000+01:00).Read-only. |

updatedDate dateTime |

The instant of time when the credit note was updated by lexoffice in format yyyy-MM-ddTHH:mm:ss.SSSXXX as described in RFC 3339/ISO 8601 (e.g. 2023-02-21T00:00:00.000+01:00).Read-only. |

version integer |

Version (revision) number which will be increased on each change to handle optimistic locking. Read-only. |

language string |

Specifies the language of the credit note which affects the print document but also set translated default text modules when no values are send (e.g. for introduction). Values accepted in ISO 639-1 code. Possible values are German de (default) and English en. |

archived boolean |

Specifies if the credit note is only available in the archive in lexoffice. Read-only. |

voucherStatus enum |

Specifies the status of the credit note. Possible values are draft (is editable), open (finalized and no longer editable but not yet paid off), paidoff (has been fully paid back to the customer), voided (cancelled) Read-only. |

voucherNumber string |

The specific number a credit note is aware of. This consecutive number is set by lexoffice on creation. Read-only. |

voucherDate dateTime |

The date of credit note in format yyyy-MM-ddTHH:mm:ss.SSSXXX as described in RFC 3339/ISO 8601 (e.g. 2023-02-21T00:00:00.000+01:00). |

address object |

The address of the credit note recipient. For details see below. |

electronicDocumentProfile enum |

The electronic document profile of the credit note. Possible values are NONE (no electronic document profile, also returned for non-invoice sales vouchers and draft invoices), EN16931 (ZUGFeRD), and XRechnung (XRechnung enabled invoice). Read-only. |

lineItems list |

The items of the credit note. For details see below. |

totalPrice object |

The total price of the credit note. For details see below. |

taxAmounts list |

The tax amounts for each tax rate. Please note: As done with every read-only element or object all submitted content (POST) will be ignored. For details see below. Read-only. |

taxConditions object |

The tax conditions of the credit note. For details see below. |

relatedVouchers list |

The related vouchers of the credit note. Read-only. |

printLayoutId uuid |

(Optional) The id of the print layout to be used for the credit note. The organization's default print layout will be used if no value is sent. |

title string |

(Optional) A title text. The organization's default is used if no value was sent. |

introduction string |

(Optional) An introductory text / header. The organization's default is used if no value was sent. We recommended to include the invoice number in the header when the credit note is related to an invoice. |

remark string |

(Optional) A closing text note. The organization's default is used if no value was sent. |

files object |

The document id for the PDF version of the credit note. For details see below. Read-only. |

Address Details

There are two main options to address the recipient of a credit note. First, using an existing lexoffice contact or second, creating a new address.

For referencing an existing contact it is only necessary to provide the UUID of that contact. Usually the billing address is used (for delivery notes, the shipping address will be preferred). Additionally, the referenced address can also be modified for this specific credit note. This can be done by setting all required address fields and this deviated address will not be stored back to the lexoffice contacts.

Otherwise, a new address for the credit note recipient can be created. That type of address is called a "one-time address". A one-time address will not create a new contact in lexoffice. For instance, this could be useful when it is not needed to create a contact in lexoffice for each new credit note.

Please get in touch with us if you are not sure which option fits your use case best.

| Property | Description |

|---|---|

contactId uuid |

If the credit note recipient is (optionally) registered as a contact in lexoffice, this field specifies the related id of the contact. |

name string |

The name of the credit note recipient. To use an existing contact of an individual person, provide the name in the format {firstname} {lastname}. |

supplement string |

(Optional) An address supplement. |

street string |

The street (street and street number) of the address. |

city string |

The city of the address. |

zip string |

The zip code of the address. |

countryCode enum |

The ISO 3166 alpha2 country code of the address. |

contactPerson string |

The contact person selected while editing the voucher. The primary contact person will be used when creating vouchers via the API with a referenced contactId.Read-only. |

Line Items Details

For referencing an existing product or service, it is necessary to provide its UUID. However, all required properties must still be specified for the referencing line item. Additionally, the referenced product or service can be modified by adjusting the input. This deviated data will not be stored back to the product/service in lexoffice.

| Property | Description |

|---|---|

id uuid |

The field specifies the related id of a referenced product/service. |

type enum |

The type of the item. Possible values are service (the line item is related to a supply of services), material (the line item is related to a physical product), custom (an item without reference in lexoffice and has no id) or text (contains only a name and/or a description for informative purposes). |

name string |

The name of the item. |

description string |

The description of the item. |

quantity number |

The amount of the purchased item. The value can contain up to 4 decimals. |

unitName string |

The unit name of the purchased item. If the provided unit name is not known in lexoffice it will be created on the fly. |

unitPrice object |

The unit price of the purchased item. For details see below. |

lineItemAmount number |

The total price of this line item. Depending by the selected taxType in taxConditions, the amount must be given either as net or gross. The value can contain up to 2 decimals. Read-only. |

Unit Price Details

| Property | Description |

|---|---|

currency enum |

The currency of the price. Currently only EUR is supported. |

netAmount number |

The net price of the unit price. The value can contain up to 4 decimals. |

grossAmount number |

The gross price of the unit price. The value can contain up to 4 decimals. |

taxRatePercentage number |

The tax rate of the unit price. See the "Supported tax rates" FAQ for more information and a list of possible values.. For vat-free sales vouchers the tax rate percentage must be 0. |

Total Price Details

| Property | Description |

|---|---|

currency string |

The currency of the total price. Currently only EUR is supported. |

totalNetAmount number |

The total net price over all line items. The value can contain up to 2 decimals. Read-only. |

totalGrossAmount number |

The total gross price over all line items. The value can contain up to 2 decimals. Read-only. |

totalTaxAmount number |

The total tax amount over all line items. The value can contain up to 2 decimals. Read-only. |

totalDiscountAbsolute number |

(Optional) A total discount as absolute value. The value can contain up to 2 decimals. |

totalDiscountPercentage number |

(Optional) A total discount relative to the gross amount or net amount dependent on the given tax conditions. A contact-specific default will be set if available and no total discount was send. The value can contain up to 2 decimals. |

Tax Amounts Details

| Property | Description |

|---|---|

taxRatePercentage number |

Tax rate as percentage value. See the "Supported tax rates" FAQ for more information and a list of possible values.. |

taxAmount number |

The total tax amount for this tax rate. The value can contain up to 2 decimals. |

netAmount number |

The total net amount for this tax rate. The value can contain up to 2 decimals. |

Tax Conditions Details

Sample for vat-free tax conditions

"taxConditions": {

"taxType": "constructionService13b",

"taxTypeNote": "Steuerschuldnerschaft des Leistungsempfängers (Reverse Charge)"

}

| Property | Description |

|---|---|

taxType enum |

The tax type for the credit note. Possible values are net, gross, vatfree (Steuerfrei), intraCommunitySupply (Innergemeinschaftliche Lieferung gem. §13b UStG), constructionService13b (Bauleistungen gem. §13b UStG), externalService13b (Fremdleistungen innerhalb der EU gem. §13b UStG), thirdPartyCountryService (Dienstleistungen an Drittländer), thirdPartyCountryDelivery (Ausfuhrlieferungen an Drittländer), and photovoltaicEquipment (0% taxation for photovoltaic equipment and installations in Germany starting 2023-01, Material und Leistungen für Photovoltaik-Installationen) |

taxSubType enum |

A tax subtype. Only required for dedicated cases. For vouchers referencing a B2C customer in the EU, and with a taxType of net or gross, the taxSubType may be set to distanceSales, or electronicServices. Passing a null value results in a standard voucher.If the organization's distanceSalesPrinciple (profile endpoint) is set to DESTINATION and this attribute is set to distanceSales or electronicServices, the voucher needs to reference the destination country's tax rates. |

taxTypeNote string |

When taxType is set to a vat-free tax type then a note regarding the conditions can be set. When omitted lexoffice sets the organization's default. |

Related Vouchers Details

The relatedVouchers property documents all existing voucher relations for the current sales voucher. If no related vouchers exist, an empty list will be returned.

| Property | Description |

|---|---|

id uuid |

The related sales voucher's unique id. |

voucherNumber string |

The specific number of the related sales voucher. Read-only. |

voucherType string |

Voucher type of the related sales voucher. |

All attributes listed above are read-only.

Files Details

| Property | Description |

|---|---|

documentFileId uuid |

The id of the credit note PDF. The PDF will be created when the credit note turns from draft into status open or paidoff. To download the credit note PDF file please use the files endpoint. |

Create a Credit Note

Sample request to create a credit note

curl https://api.lexoffice.io/v1/credit-notes

-X POST

-H "Authorization: Bearer {accessToken}"

-H "Content-Type: application/json"

-H "Accept: application/json"

-d '

{

"archived": false,

"voucherDate": "2023-02-22T00:00:00.000+01:00",

"address": {

"name": "Bike & Ride GmbH & Co. KG",

"supplement": "Gebäude 10",

"street": "Musterstraße 42",

"city": "Freiburg",

"zip": "79112",

"countryCode": "DE"

},

"lineItems": [

{

"type": "custom",

"name": "Abus Kabelschloss Primo 590 ",

"description": "· 9,5 mm starkes, smoke-mattes Spiralkabel mit integrierter Halterlösung zur Befestigung am Sattelklemmbolzen · bewährter Qualitäts-Schließzylinder mit praktischem Wendeschlüssel · KabelØ: 9,5 mm, Länge: 150 cm",

"quantity": 2,

"unitName": "Stück",

"unitPrice": {

"currency": "EUR",

"netAmount": 13.4,

"taxRatePercentage": 19

}

},

{

"type": "custom",

"name": "Energieriegel Testpaket",

"quantity": 1,

"unitName": "Stück",

"unitPrice": {

"currency": "EUR",

"netAmount": 5,

"taxRatePercentage": 0

}

},

{

"type": "text",

"name": "Strukturieren Sie Ihre Belege durch Text-Elemente.",

"description": "Das hilft beim Verständnis"

}

],

"totalPrice": {

"currency": "EUR"

},

"taxConditions": {

"taxType": "net"

},

"title": "Rechnungskorrektur",

"introduction": "Rechnungskorrektur zur Rechnung RE-00020",

"remark": "Folgende Lieferungen/Leistungen schreiben wir Ihnen gut."

}

'

Sample response

{

"id": "e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"resourceUri": "https://api.lexoffice.io/v1/credit-notes/e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"createdDate": "2023-06-17T18:32:07.480+02:00",

"updatedDate": "2023-06-17T18:32:07.551+02:00",

"version": 1

}

POST {resourceurl}/v1/credit-notes[?finalize=true]

Credit notes transmitted via the API are created in draft mode per default. To create a finalized credit note with status open the optional query parameter finalize has to be set. The status of a credit note cannot be changed via the api.

The created credit note will be shown in the main voucher list in lexoffice: https://app.lexoffice.de/vouchers. To provide your customers access to the created credit note please use our deeplink function.

The contents of the credit note are expected in the request's body as an application/json and must not contain read-only fields. See our FAQ on further information on text fields.

Description of required properties when creating a credit note.

| Property | Required | Notes |

|---|---|---|

| voucherDate | Yes | |

| address | Yes | Nested object. Required fields for address please see below. |

| lineItems | Yes | List of nested objects. Required fields for lineItems please see below. |

| totalPrice | Yes | Nested object. Required fields for totalPrice please see below. |

| taxConditions | Yes | Nested object. Required fields for taxConditions see below. |

Address Required Properties

Description of required address properties when creating a credit note.

| Property | Required | Notes |

|---|---|---|

| contactId | * | Only when referencing an existing lexoffice contact. |

| name | * | Only required when no existing contact is referenced. |

| countryCode | * | Only required when no existing contact is referenced. |

Line Items Required Properties

Description of required lineItem properties when creating a credit note.

| Property | Required | Notes |

|---|---|---|

| id | * | Required for type service and material. |

| type | Yes | Supported values are custom, material, service and text. |

| name | Yes | |

| quantity | * | Required for type custom, service and material. |

| unitName | * | Required for type custom, service and material. |

| unitPrice | * | Required for type custom, service and material. Nested object. Required fields for unitPrice see below. |

Unit Price Required Properties

Description of required unitPrice properties when creating a credit note.

| Property | Required | Notes |

|---|---|---|

| currency | Yes | |

| netAmount | * | Only relevant if taxConditions.taxType != gross is delivered. |

| grossAmount | * | Only relevant if taxConditions.taxType == gross is delivered. |

| taxRatePercentage | Yes | Must be 0 for vat-free sales voucher. |

Total Price Required Properties

Description of required totalPrice properties when creating a credit note.

| Property | Required | Notes |

|---|---|---|

| currency | Yes |

Tax Condition Required Properties

Description of required tax condition properties when creating a credit note.

| Property | Required | Notes |

|---|---|---|

| taxType | Yes | Supported values are: gross, net, vatfree, intraCommunitySupply, constructionService13b, externalService13b, thirdPartyCountryService, thirdPartyCountryDelivery. |

Pursue to a Credit Note

POST {resourceurl}/v1/credit-notes?precedingSalesVoucherId={id}[&finalize=true]

To be able to pursue a sales voucher to a credit note, the optional query parameter

precedingSalesVoucherId needs to be set. The id value {id} refers to the preceding sales voucher which is going to be pursued.

To get an overview of the valid and possible pursue actions in lexoffice, please see the linked sales voucher document chain. The recommended process is highlighted in blue. If the pursue action is not valid, the request will be rejected with 406 response.

When referenced to an invoice, a finalized credit note is immediately paidoff and the open amount of the invoice is reduced by the amount of the credit note.

Retrieve a Credit Note

Sample request

curl https://api.lexoffice.io/v1/credit-notes/e9066f04-8cc7-4616-93f8-ac9ecc8479c8

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample response

{

"id": "e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"organizationId": "aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"createdDate": "2023-06-17T18:32:07.480+02:00",

"updatedDate": "2023-06-17T18:32:07.551+02:00",

"version": 1,

"language": "de",

"archived": false,

"voucherStatus": "draft",

"voucherNumber": "GS0007",

"voucherDate": "2023-02-22T00:00:00.000+01:00",

"address": {

"name": "Bike & Ride GmbH & Co. KG",

"supplement": "Gebäude 10",

"street": "Musterstraße 42",

"city": "Freiburg",

"zip": "79112",

"countryCode": "DE"

},

"lineItems": [

{

"type": "custom",

"name": "Abus Kabelschloss Primo 590 ",

"description": "· 9,5 mm starkes, smoke-mattes Spiralkabel mit integrierter Halterlösung zur Befestigung am Sattelklemmbolzen · bewährter Qualitäts-Schließzylinder mit praktischem Wendeschlüssel · KabelØ: 9,5 mm, Länge: 150 cm",

"quantity": 2,

"unitName": "Stück",

"unitPrice": {

"currency": "EUR",

"netAmount": 13.4,

"grossAmount": 15.946,

"taxRatePercentage": 19

},

"lineItemAmount": 26.8

},

{

"type": "custom",

"name": "Energieriegel Testpaket",

"quantity": 1,

"unitName": "Stück",

"unitPrice": {

"currency": "EUR",

"netAmount": 5,

"grossAmount": 5,

"taxRatePercentage": 0

},

"lineItemAmount": 5

}

],

"totalPrice": {

"currency": "EUR",

"totalNetAmount": 31.8,

"totalGrossAmount": 36.89,

"totalTaxAmount": 5.09

},

"taxAmounts": [

{

"taxRatePercentage": 0,

"taxAmount": 0,

"netAmount": 5

},

{

"taxRatePercentage": 19,

"taxAmount": 5.09,

"netAmount": 26.8

}

],

"taxConditions": {

"taxType": "net"

},

"title": "Rechnungskorrektur",

"introduction": "Rechnungskorrektur zur Rechnung RE-00020",

"remark": "Folgende Lieferungen/Leistungen schreiben wir Ihnen gut."

}

GET {resourceurl}/v1/credit-notes/{id}

Returns the credit note with id value {id}.

Render a Credit Note Document (PDF)

Sample request

curl https://api.lexoffice.io/v1/credit-notes/e9066f04-8cc7-4616-93f8-ac9ecc8479c8/document

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample response

{

"documentFileId": "b26e1d73-19ff-46b1-8929-09d8d73d4167"

}

GET {resourceurl}/v1/credit-notes/{id}/document

To download the PDF file of a credit note document, you need its documentFileId. This id is usually returned by the credit note resource. However, PDF document file rendering must be triggered separately via this endpoint for credit notes created through the API with the status open.

The returned documentFileId can be used to download the credit note PDF document via the (Files Endpoint).

Deeplink to a Credit Note

Credit notes can be directly accessed by permanent HTTPS links to either be viewed or to be edited. If a credit note is not allowed to be edited, a redirection to the view page takes place.

In case the given id does not exist, a redirection to the main voucher list takes place.

View URL {appbaseurl}/permalink/credit-notes/view/{id}

Edit URL {appbaseurl}/permalink/credit-notes/edit/{id}

Delivery Notes Endpoint

Purpose

This endpoint provides read and write access to delivery notes and also the possibility to render the document as a PDF in order to download it. Delivery notes can be created as a draft or finalized in open mode.

When creating delivery notes to existing invoices, it is recommended to use the pursue action to create a reference between the documents. Please note, that the printed document does not show the related invoice resp. the invoice number. However, to show the invoice number, it can simply be included in the header text (introduction).

Delivery notes contain neither payment conditions nor prices, reductions and tax amounts.

Delivery Notes Properties

Sample of a delivery note with multiple line items. Fields with no content are displayed with "null" just for demonstration purposes.

{

"id":"e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"organizationId":"aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"createdDate":"2023-06-17T18:32:07.480+02:00",

"updatedDate":"2023-06-17T18:32:07.551+02:00",

"version":1,

"language":"de",

"archived":false,

"voucherStatus":"draft",

"voucherNumber":"LS0007",

"voucherDate":"2023-02-22T00:00:00.000+01:00",

"address":{

"name":"Bike & Ride GmbH & Co. KG",

"supplement":"Gebäude 10",

"street":"Musterstraße 42",

"city":"Freiburg",

"zip":"79112",

"countryCode":"DE"

},

"electronicDocumentProfile":"NONE",

"lineItems":[

{

"type":"custom",

"name":"Abus Kabelschloss Primo 590 ",

"description":"· 9,5 mm starkes, smoke-mattes Spiralkabel mit integrierter Halterlösung zur Befestigung am Sattelklemmbolzen · bewährter Qualitäts-Schließzylinder mit praktischem Wendeschlüssel · KabelØ: 9,5 mm, Länge: 150 cm",

"quantity":2,

"unitName":"Stück",

"unitPrice":{

"currency":"EUR",

"netAmount":13.4,

"grossAmount":15.946,

"taxRatePercentage":19

}

},

{

"type":"custom",

"name":"Energieriegel Testpaket",

"quantity":1,

"unitName":"Stück",

"unitPrice":{

"currency":"EUR",

"netAmount":5,

"grossAmount":5,

"taxRatePercentage":0

}

}

],

"taxConditions":{

"taxType":"net"

},

"relatedVouchers":[],

"printLayoutId": "28c212c4-b6dd-11ee-b80a-dbc65f4ceccf",

"title":"Lieferschein",

"introduction":"Lieferschein zur Rechnung RE-00020",

"remark":"Folgende Lieferungen/Leistungen schreiben wir Ihnen gut.",

"files":{

"documentFileId":"a79fea19-a892-4ea9-89ad-e879946329a3"

}

}

| Property | Description |

|---|---|

id uuid |

Unique id generated on creation by lexoffice. Read-only. |

organizationId uuid |

Unique id of the organization the delivery note belongs to. Read-only. |

createdDate dateTime |

The instant of time when the delivery note was created by lexoffice in format yyyy-MM-ddTHH:mm:ss.SSSXXX as described in RFC 3339/ISO 8601 (e.g. 2023-02-21T00:00:00.000+01:00).Read-only. |

updatedDate dateTime |

The instant of time when the delivery note was updated by lexoffice in format yyyy-MM-ddTHH:mm:ss.SSSXXX as described in RFC 3339/ISO 8601 (e.g. 2023-02-21T00:00:00.000+01:00).Read-only. |

version integer |

Version (revision) number which will be increased on each change to handle optimistic locking. Read-only. |

language string |

Specifies the language of the delivery note which affects the print document but also set translated default text modules when no values are send (e.g. for introduction). Values accepted in ISO 639-1 code. Possible values are German de (default) and English en. |

archived boolean |

Specifies if the delivery note is only available in the archive in lexoffice. Read-only. |

voucherStatus enum |

Specifies the status of the delivery note. Possible values are draft (is editable) and open (finalized and no longer editable). Read-only. |

voucherNumber string |

The specific number a delivery note is aware of. This consecutive number is set by lexoffice on creation. Read-only. |

voucherDate dateTime |

The date of delivery note in format yyyy-MM-ddTHH:mm:ss.SSSXXX as described in RFC 3339/ISO 8601 (e.g. 2023-02-21T00:00:00.000+01:00). |

address object |

The address of the delivery note recipient. For details see below. |

electronicDocumentProfile enum |

The electronic document profile of the delivery note. Always contains the value NONE. Read-only. |

lineItems list |

The items of the delivery note. For details see below. |

taxConditions object |

The tax conditions of the delivery note. For details see below. |

relatedVouchers list |

The related vouchers of the delivery note. Read-only. |

printLayoutId uuid |

(Optional) The id of the print layout to be used for the delivery note. The organization's default print layout will be used if no value is sent. |

title string |

(Optional) A title text. The organization's default is used if no value was sent. |

introduction string |

(Optional) An introductory text / header. The organization's default is used if no value was sent. We recommend to include the invoice number in the header when the delivery note is related to an invoice. |

remark string |

(Optional) A closing text note. The organization's default is used if no value was sent. |

deliveryTerms string |

(Optional) Describes the terms for delivery. The organization's (or contact-specific) default is used if no value was sent. |

files object |

The document id for the PDF version of the delivery note. For details see below. Read-only. |

Address Details

There are two main options to address the recipient of a delivery note. First, using an existing lexoffice contact or second, creating a new address.

For referencing an existing contact it is only necessary to provide the UUID of that contact. Usually the billing address is used (for delivery notes, the shipping address will be preferred). Additionally, the referenced address can also be modified for this specific delivery note. This can be done by setting all required address fields and this deviated address will not be stored back to the lexoffice contacts.

Otherwise, a new address for the delivery note recipient can be created. That type of address is called a "one-time address". A one-time address will not create a new contact in lexoffice. For instance, this could be useful when it is not needed to create a contact in lexoffice for each new delivery note.

Please get in touch with us if you are not sure which option fits your use case best.

| Property | Description |

|---|---|

contactId uuid |

If the delivery note recipient is (optionally) registered as a contact in lexoffice, this field specifies the related id of the contact. |

name string |

The name of the delivery note recipient. To use an existing contact of an individual person, provide the name in the format {firstname} {lastname}. |

supplement string |

(Optional) An address supplement. |

street string |

The street (street and street number) of the address. |

city string |

The city of the address. |

zip string |

The zip code of the address. |

countryCode enum |

The ISO 3166 alpha2 country code of the address. |

contactPerson string |

The contact person selected while editing the voucher. The primary contact person will be used when creating vouchers via the API with a referenced contactId.Read-only. |

Line Items Details

For referencing an existing product or service, it is necessary to provide its UUID. However, all required properties must still be specified for the referencing line item. Additionally, the referenced product or service can be modified by adjusting the input. This deviated data will not be stored back to the product/service in lexoffice.

| Property | Description |

|---|---|

id uuid |

The field specifies the related id of a referenced product/service. |

type enum |

The type of the item. Possible values are service (the line item is related to a supply of services), material (the line item is related to a physical product), custom (an item without reference in lexoffice and has no id) or text (contains only a name and/or a description for informative purposes). |

name string |

The name of the item. |

description string |

The description of the item. |

quantity number |

The amount of the purchased item. The value can contain up to 4 decimals. |

unitName string |

The unit name of the purchased item. If the provided unit name is not known in lexoffice it will be created on the fly. |

unitPrice object |

The unit price of the purchased item. For details see below. |

lineItemAmount number |

The total price of this line item. Depending by the selected taxType in taxConditions, the amount must be given either as net or gross. The value can contain up to 2 decimals. Read-only. |

Unit Price Details

| Property | Description |

|---|---|

currency enum |

The currency of the price. Currently only EUR is supported. |

netAmount number |

The net price of the unit price. The value can contain up to 4 decimals. |

grossAmount number |

The gross price of the unit price. The value can contain up to 4 decimals. |

taxRatePercentage number |

The tax rate of the unit price. See the "Supported tax rates" FAQ for more information and a list of possible values.. For vat-free sales vouchers the tax rate percentage must be 0. |

Tax Conditions Details

Sample for vat-free tax conditions

"taxConditions": {

"taxType": "constructionService13b",

"taxTypeNote": "Steuerschuldnerschaft des Leistungsempfängers (Reverse Charge)"

}

| Property | Description |

|---|---|

taxType enum |

The tax type for the delivery note. Possible values are net, gross, vatfree (Steuerfrei), intraCommunitySupply (Innergemeinschaftliche Lieferung gem. §13b UStG), constructionService13b (Bauleistungen gem. §13b UStG), externalService13b (Fremdleistungen innerhalb der EU gem. §13b UStG), thirdPartyCountryService (Dienstleistungen an Drittländer), thirdPartyCountryDelivery (Ausfuhrlieferungen an Drittländer), and photovoltaicEquipment (0% taxation for photovoltaic equipment and installations in Germany starting 2023-01, Material und Leistungen für Photovoltaik-Installationen) |

taxSubType enum |

A tax subtype. Only required for dedicated cases. For vouchers referencing a B2C customer in the EU, and with a taxType of net or gross, the taxSubType may be set to distanceSales, or electronicServices. Passing a null value results in a standard voucher.If the organization's distanceSalesPrinciple (profile endpoint) is set to DESTINATION and this attribute is set to distanceSales or electronicServices, the voucher needs to reference the destination country's tax rates. |

taxTypeNote string |

When taxType is set to a vat-free tax type then a note regarding the conditions can be set. When omitted lexoffice sets the organization's default. |

Related Vouchers Details

The relatedVouchers property documents all existing voucher relations for the current sales voucher. If no related vouchers exist, an empty list will be returned.

| Property | Description |

|---|---|

id uuid |

The related sales voucher's unique id. |

voucherNumber string |

The specific number of the related sales voucher. Read-only. |

voucherType string |

Voucher type of the related sales voucher. |

All attributes listed above are read-only.

Files Details

| Property | Description |

|---|---|

documentFileId uuid |

The id of the order confirmation PDF. To download the order confirmation PDF file please use the files endpoint. |

Create a Delivery Note

Sample request to create a delivery note

curl https://api.lexoffice.io/v1/delivery-notes

-X POST

-H "Authorization: Bearer {accessToken}"

-H "Content-Type: application/json"

-H "Accept: application/json"

-d '

{

"archived": false,

"voucherDate": "2023-02-22T00:00:00.000+01:00",

"address": {

"name": "Bike & Ride GmbH & Co. KG",

"supplement": "Gebäude 10",

"street": "Musterstraße 42",

"city": "Freiburg",

"zip": "79112",

"countryCode": "DE"

},

"lineItems": [

{

"type": "custom",

"name": "Abus Kabelschloss Primo 590 ",

"description": "· 9,5 mm starkes, smoke-mattes Spiralkabel mit integrierter Halterlösung zur Befestigung am Sattelklemmbolzen · bewährter Qualitäts-Schließzylinder mit praktischem Wendeschlüssel · KabelØ: 9,5 mm, Länge: 150 cm",

"quantity": 2,

"unitName": "Stück",

"unitPrice": null

},

{

"type": "custom",

"name": "Energieriegel Testpaket",

"quantity": 1,

"unitName": "Stück",

"unitPrice": null

},

{

"type": "text",

"name": "Strukturieren Sie Ihre Belege durch Text-Elemente.",

"description": "Das hilft beim Verständnis"

}

],

"taxConditions": {

"taxType": "net"

},

"title": "Lieferschein",

"introduction": "Lieferschein zur Rechnung RE-00020",

"deliveryTerms": "Lieferung frei Haus.",

"remark": "Folgende Lieferungen/Leistungen schreiben wir Ihnen gut."

}

'

Sample response

{

"id": "e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"resourceUri": "https://api.lexoffice.io/v1/delivery-notes/e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"createdDate": "2023-06-17T18:32:07.480+02:00",

"updatedDate": "2023-06-17T18:32:07.551+02:00",

"version": 1

}

POST {resourceurl}/v1/delivery-notes[?finalize=true]

Delivery notes transmitted via the API are created in draft mode per default. To create a finalized delivery note with status open the optional query parameter finalize has to be set. The status of a delivery note cannot be changed via the api.

The created delivery note will be shown in the main voucher list in lexoffice: https://app.lexoffice.de/vouchers. To provide your customers access to the created delivery note please use our deeplink function.

The contents of the delivery note are expected in the request's body as an application/json and must not contain read-only fields.

Description of required properties when creating a delivery note.

| Property | Required | Notes |

|---|---|---|

| voucherDate | Yes | |

| address | Yes | Nested object. Required fields for address please see below. |

| lineItems | Yes | List of nested objects. Required fields for lineItems please see below. |

| taxConditions | Yes | Nested object. Required fields for taxConditions see below. |

| shippingConditions | Yes | Nested object. Required fields for shippingConditions see below. |

Address Required Properties

Description of required address properties when creating a delivery note.

| Property | Required | Notes |

|---|---|---|

| contactId | * | Only when referencing an existing lexoffice contact. |

| name | * | Only required when no existing contact is referenced. |

| countryCode | * | Only required when no existing contact is referenced. |

Line Items Required Properties

Description of required lineItem properties when creating a delivery note.

| Property | Required | Notes |

|---|---|---|

| id | * | Required for type service and material. |

| type | Yes | Supported values are custom, material, service and text. |

| name | Yes | |

| quantity | * | Required for type custom, service and material. |

| unitName | * | Required for type custom, service and material. |

| unitPrice | No | Nested object. Required fields for unitPrice see below. Optional for delivery notes. |

Unit Price Required Properties

Description of required unitPrice properties when creating a delivery note.

| Property | Required | Notes |

|---|---|---|

| currency | Yes | |

| netAmount | * | Only relevant if taxConditions.taxType != gross is delivered. |

| grossAmount | * | Only relevant if taxConditions.taxType == gross is delivered. |

| taxRatePercentage | Yes | Must be 0 for vat-free sales voucher. |

Tax Condition Required Properties

Description of required tax condition properties when creating a delivery note.

| Property | Required | Notes |

|---|---|---|

| taxType | Yes | Supported values are: gross, net, vatfree, intraCommunitySupply, constructionService13b, externalService13b, thirdPartyCountryService, thirdPartyCountryDelivery. |

Shipping Condition Required Properties

Description of required shipping condition properties when creating a delivery note.

| Property | Required | Notes |

|---|---|---|

| shippingType | Yes | |

| shippingDate | * | Required for shipping types service, serviceperiod, delivery and deliveryperiod. |

| shippingEndDate | * | Required for shipping types serviceperiod and deliveryperiod. |

Pursue to a Delivery Note

POST {resourceurl}/v1/delivery-notes?precedingSalesVoucherId={id}

To be able to pursue a sales voucher to a delivery note, the optional query parameter

precedingSalesVoucherId needs to be set. The id value {id} refers to the preceding sales voucher which is going to be pursued.

To get an overview of the valid and possible pursue actions in lexoffice, please see the linked sales voucher document chain. The recommended process is highlighted in blue. If the pursue action is not valid, the request will be rejected with 406 response.

Retrieve a Delivery Note

Sample request

curl https://api.lexoffice.io/v1/delivery-notes/e9066f04-8cc7-4616-93f8-ac9ecc8479c8

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample response

{

"id": "e9066f04-8cc7-4616-93f8-ac9ecc8479c8",

"organizationId": "aa93e8a8-2aa3-470b-b914-caad8a255dd8",

"createdDate": "2023-06-17T18:32:07.480+02:00",

"updatedDate": "2023-06-17T18:32:07.551+02:00",

"version": 1,

"language": "de",

"archived": false,

"voucherStatus": "draft",

"voucherNumber": "LS0007",

"voucherDate": "2023-02-22T00:00:00.000+01:00",

"address": {

"name": "Bike & Ride GmbH & Co. KG",

"supplement": "Gebäude 10",

"street": "Musterstraße 42",

"city": "Freiburg",

"zip": "79112",

"countryCode": "DE"

},

"lineItems": [

{

"type": "custom",

"name": "Abus Kabelschloss Primo 590 ",

"description": "· 9,5 mm starkes, smoke-mattes Spiralkabel mit integrierter Halterlösung zur Befestigung am Sattelklemmbolzen · bewährter Qualitäts-Schließzylinder mit praktischem Wendeschlüssel · KabelØ: 9,5 mm, Länge: 150 cm",

"quantity": 2,

"unitName": "Stück",

"unitPrice": {

"currency": "EUR",

"netAmount": 13.4,

"grossAmount": 15.946,

"taxRatePercentage": 19

}

},

{

"type": "custom",

"name": "Energieriegel Testpaket",

"quantity": 1,

"unitName": "Stück",

"unitPrice": {

"currency": "EUR",

"netAmount": 5,

"grossAmount": 5,

"taxRatePercentage": 0

}

}

],

"taxConditions": {

"taxType": "net"

},

"title": "Lieferschein",

"introduction": "Lieferschein zur Rechnung RE-00020",

"deliveryTerms": "Lieferung frei Haus.",

"remark": "Folgende Lieferungen/Leistungen schreiben wir Ihnen gut."

}

GET {resourceurl}/v1/delivery-notes/{id}

Returns the delivery note with id value {id}.

Render a Delivery Note Document (PDF)

Sample request

curl https://api.lexoffice.io/v1/delivery-notes/e9066f04-8cc7-4616-93f8-ac9ecc8479c8/document

-X GET

-H "Authorization: Bearer {accessToken}"

-H "Accept: application/json"

Sample response

{

"documentFileId": "b26e1d73-19ff-46b1-8929-09d8d73d4167"

}

GET {resourceurl}/v1/delivery-notes/{id}/document

To download the PDF file of a delivery note document, you need its documentFileId. This id is usually returned by the delivery note resource. However, PDF document file rendering must be triggered separately via this endpoint for delivery notes created through the API with the status open.

The returned documentFileId can be used to download the delivery note PDF document via the (Files Endpoint).

Deeplink to a Delivery Note

Delivery notes can be directly accessed by permanent HTTPS links to either be viewed or to be edited. If a delivery note is not allowed to be edited, a redirection to the view page takes place.

In case the given id does not exist, a redirection to the main voucher list takes place.

View URL {appbaseurl}/permalink/delivery-notes/view/{id}

Edit URL {appbaseurl}/permalink/delivery-notes/edit/{id}

Dunnings Endpoint

Purpose

This endpoint provides read and write access to dunnings and also the possibility to render the document as a PDF in order to download it. Dunnings are always created in draft mode and do not need to be finalized.

A dunning requires an invoice as a reference, making the precedingSalesVoucherId a mandatory query parameter. When creating a dunning, the contact ids of the invoice and the dunning must be equal (or both be absent, resulting in a reference to the collective customer). The name attribute in the address field is copied from the referenced invoice and will be ignored in the dunning structure. The tax conditions must match the tax conditions in the referenced invoice.

Dunning a down payment invoice is possible as well.